China Removed the Gold Tax Incentive: What Happened to the China Gold Tax Incentive?

Table of Contents

ToggleIntroduction:

China gold tax incentive: What? Have you not been made aware of the news? It was a very disappointing moment for the gold market. We have been seeing gold prices skyrocket. After that, a huge event came from one of the largest bullion markets in the world. China did a quick and strong move. The move indicated that the end of the china gold tax incentive was near. The change rattled the industry. It definitely makes us rethink our gold investment strategies.

Knowing the China Gold Tax Incentive and Its Removal

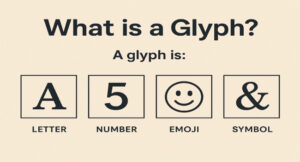

Don’t you recall that tax break? China had for quite a few years been giving a tax break for gold sales. The arrangement allowed retailers to be able to offset the Value-Added Tax (VAT). The retailers were allowed to deduct the VAT when they were selling gold that came from the Shanghai Gold Exchange (SGE). It was known by everyone as the china gold tax incentive.

Nevertheless, that time is behind them. The Ministry of Finance issued a new law which states that the tax offset that allowed for the tax break will be discontinued on November 1st, 2025. The change affects a wide range of products. It includes high purity gold bars and ingots. Besides that, the measure covers gold coins that are certified by the People’s Bank of China. In addition, the change affects such items as gold jewelry and gold used in the industry. Basically, if the gold has gone through the SGE and is meant for a retailer, the tax benefit is entirely taken away.

Why Did China Decide to Go without the Gold Perk?

Many of my friends asked the same question: why now? Firstly, one needs to consider China’s economy beforehand. The real estate market hasn’t been doing well. The slow growth of the market has had a negative impact on the government’s budget. To stabilize the budget, the government had to find a way to increase its income. Therefore, getting rid of the gold tax break was an easy decision for them. It helps to bring back the money that is due to the public. For Beijing, it is a direct financial lever.

They show to us with this move that the government is highly concerned about fiscal stability. This implies that they have put retaining the gold purchasing benefit on the back burner and opted for increased state revenue instead. Maintaining the long-running china gold tax incentive> was just too costly for the government. The price of gold in China will, therefore, most probably go up.

Market Reaction After the End of the China Gold Tax Incentive

The precious metal market was quite affected by the termination of the china gold tax incentive. It was a decision that caused immediate shockwaves. The drop in gold prices was considerable. This drop was also due to other factors. For example, the seasonal buying period in India had already finished. The easing of trade tensions between the US and China also contributed to the decrease in safe-haven demand.

We witnessed the most severe gold price crash in more than ten years. It was quite the opposite of what happened before. The global buying spree had been putting a lot of pressure on prices, which is why gold was very expensive. On the contrary, the elimination of the tax benefit played a major role in the price fall. The market had to come to terms with the new reality. The retail investors from all over the world were responsible for an unprecedented rally. The removal of this key support mechanism in China led to a correction.

Customers and the Price of the China Gold Tax Incentive Withdrawal

It is a piece of news that will directly impact the average gold buyer in China. In the end, the price of physical gold will be going up. The retailers will no longer be able to offset the VAT. They will have no other option but to pass on this extra cost to the consumer. Imagine that you are buying a gold necklace. Or maybe, investing in a gold bar. The buyers will be the ones to pay more for that piece of gold from now on.

I was talking about gold with a friend of mine who is a commodities trader. She said that the china gold tax incentive was instrumental in making the consumers be able to afford high-purity gold. The government is now at a crossroad China gold tax break. They can gain revenue, but at the same time, they also cut the consumer demand for gold products. The rise in the price of gold affects all sectors. The high-purity gold that is meant for investment is hit with price increases. The manufacturing cost of the jewelers, who rely on the china gold tax incentive, is also going up.

What Next: A Glance at the Future of Gold

Nevertheless the present upheaval, gold is expected to perform well in the long run. It is always good to keep the right perspective. The alteration to the china gold tax incentive is a structural one and not a fundamental threat to gold’s value. Gold is still trading near its recent peaks (such as the $4,000-an-ounce level referred to in the original report).

What is the reason for this? Firstly, global central banks are on the buying side. Secondly, there are rate-cut expectations in the US. Lower rates usually result in making non-yielding assets like gold more attractive. Finally, the world is still full of troubles. That is why the safe haven demand for gold is still there. Besides, many experts in the industry set the target price for the metal at $5,000 per ounce in the following year. This long-term prediction is based on these powerful fundamentals.

So, what are the lessons we should learn? China’s action is a major shift in its fiscal policy. It has had the effect of making gold more expensive for Chinese buyers. The removal of the china gold tax incentive was a move that had to happen for China’s public finances. However, the global demand for gold is propelled by factors other than this single tax break. It is a temporary blow, and the gold bull run could still be on its way. Keep looking at the charts, mate!

Also Read:-How to Make $100 a Day Using Apps That Actually Pay

Faq’s

1. What is the Golden Tax Rule in China?

It is a tax system in China that records VAT invoices. For gold, regular bullion is free of VAT, while jewellery and non-standard gold are charged.

2. Is China still buying gold in 2025?

China’s central bank and traders are still buying gold, therefore reserves and imports remain high.

3. How does China’s gold tax change affect India?

If the demand in China is reduced the global prices may become lower, thus giving India the benefit of cheaper gold imports and price stability.

I am Tech Tobi — the Editor & Admin of Tech Radar Hub, Blogger, and Senior SEO Analyst. My passion is simplifying tech and SEO by giving real, easy-to-understand insights that readers can use to stay ahead. Off the hook of work, I might be found discovering the newest tech updates for you to keep upto date.

Post Comment