Qualcomm Share Price: A Friendly Look at What’s Going On?

Table of Contents

ToggleIntroduction

Hi! You know, if you have had your eyes on the stock market lately, you would have probably heard a lot about the Qualcomm share price. So did I. I got a coffee, fired up my laptop, and started figuring out the truth. We can take it apart here in simple words — no complicated charts or confusing jargon, just plain talk.

What’s the Qualcomm Share Price Right Now?

The Qualcomm share price has been changing in an interesting way and it has been close to the upper end of the yearly average which is a sign of good confidence of investors in the company. Qualcomm stock has been volatile in the last 12 months. It has been going up nicely every time a hit-market news about AI or 5G has come out. And, honestly, this doesn’t shock me — Qualcomm is one of those tech giants that are quietly the most responsible for our daily lives.

The main reasons for the Qualcomm share price to go up would be new innovations, good profits, or a better view of the semiconductor market.

Why Everyone’s Talking About Qualcomm Share Price

So, why is everyone suddenly interested in Qualcomm?

To begin with, Qualcomm is not just a “smartphone chip” company anymore. It is moving into such areas as artificial intelligence, automotive tech, and Internet of Things (IoT). It’s a big thing. These are the future markets which are bringing in new excitement and value for the stock.

When a company does such diversification, investors usually become more confident in the company and you will see it in the rise of the Qualcomm share price. People can’t get enough of growth stories, and this one is coming out great.

How to Read Qualcomm’s Share Price Movement

If you are similar to me, you probably keep looking at the stock chart and wondering: “Why does it fluctuate so much?”

This is my point of view:

- After the release of good earnings, Qualcomm’s share price is likely to increase.

- News about the industry such as chip shortages or the decrease in the smartphone market may cause a temporary drop in the price.

- Moreover, if there is considerable excitement regarding AI or new technology partnerships, it is very likely that the Qualcomm share price will be moving upward.

Look at it this way — the share price is like a mirror showing the world’s perception of Qualcomm’s future at the time.

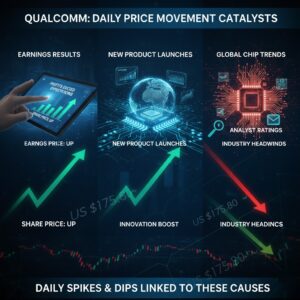

What Affects Qualcomm Share Price Day-to-Day

The main factors that influence the Qualcomm share price are:

- Earnings results – When quarterly profits exceed expectations, investors are positively inclined.

- New product launches – The market gets excited with Qualcomm’s latest chip innovations or mutually beneficial projects.

- Analyst ratings – When an analyst increases his target price, usually more buyers appear and thus the stock gets uplifted.

- Global chip trends – The state of the semiconductor industry directly affects the performance of Qualcomm.

- Economic news – Large-scale events like interest rate changes may have an effect on tech stocks in general.

Therefore, sudden spikes or dips that you notice are generally linked to these causes.

My Personal Take on Qualcomm Share Price

Allow me to be frank — if you, I, and tea were in a chat, I’d tell you that I really like the path Qualcomm is taking. The company is not just getting by on its smartphone heritage; instead, it is spreading its wings into the fields that might be the ones of the tech of the next 10 years.

The Qualcomm share price is probably not at its peak, but that is not necessarily bad. Almost the entire market is down, so this is actually a good chance for Qualcomm to take off again and reach new heights in the next few months or years.

From my standpoint, I would suggest the following: If you are long-term investor, then the stock of Qualcomm is one to watch. It has solid fundamentals, a wide-open market, and a history of innovation — all these could be the reasons behind the stock price going up over time.

Things to Watch About Qualcomm Share Price

If you are the type of person who would keep track of this stock regularly, then here are some things you should be aware of:

- Revenue mix –Determine how much revenue the company earns from non-smartphone sectors such as AI and automotive.

- Profit margins – In case the new business areas make margins lower, the stock price might respond negatively.

- New partnerships – The announcement of new collaborations usually results in the Qualcomm share price going up.

- Technology trends – Any rise in AI, 5G, or IoT will most likely benefit Qualcomm as a company and its value.

- Investor sentiment – Positive rating or strong forecast can hardly be ignored by the market.

Conclusion

Basically, the Qualcomm share price is the most intriguing story among the tech stocks at the moment. It is not only about chips any longer; it is rather about the future of connectivity, smart devices, and AI-driven innovation.

If I had to choose one sentence to describe the situation, it would be: Qualcomm reminds me of that smart but quiet guy who is always working behind the scenes but when the spotlight comes, he turns out to be the star.

Hence, whether you are a long-term investor, a learner who is curious, or simply someone who likes to keep up with the market trends, do not forget to watch the Qualcomm share price. It tells a fascinating story — one that is still being written.

Also Read: iPhone 17 Pro 2025 — Power, Precision, and Pure Innovation

I am Tech Tobi — the Editor & Admin of Tech Radar Hub, Blogger, and Senior SEO Analyst. My passion is simplifying tech and SEO by giving real, easy-to-understand insights that readers can use to stay ahead. Off the hook of work, I might be found discovering the newest tech updates for you to keep upto date.

Post Comment