Nokia Share Price: Recent Surge Sparks New Interest

One of the major things through which people can realize about Nokia is its share price. While chatting with a friend yesterday, he said, “Nokia is suddenly back in the spotlight.” And honestly, that is true. The story lying behind this huge surge is quite terrific.

Table of Contents

Toggle🔍 What’s Driving the Change in Nokia Share Price

It is better to understand the real reasons for the Nokia share price before looking at the figures.

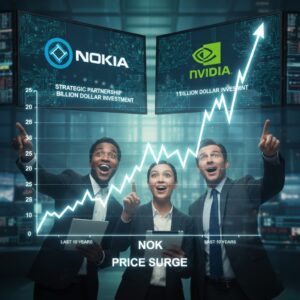

Nvidia made public just recently its decision to invest 1 billion dollars in Nokia in return for a nearly 3% stake of the total shares held in the technology company. The pact intends to have Nokia using Nvidia’s AI silicon for 5G, 6G, and data-centre network upgrading applications.

Within an hour after the news went out, the stock price of the Finnish-based tech company rose from 20 to 28% (approximately) and thus it marked a level not seen within the last ten years. Looking at that chart, it came to my mind, “This must be more than a temporary effect — this could be a real turning point.”

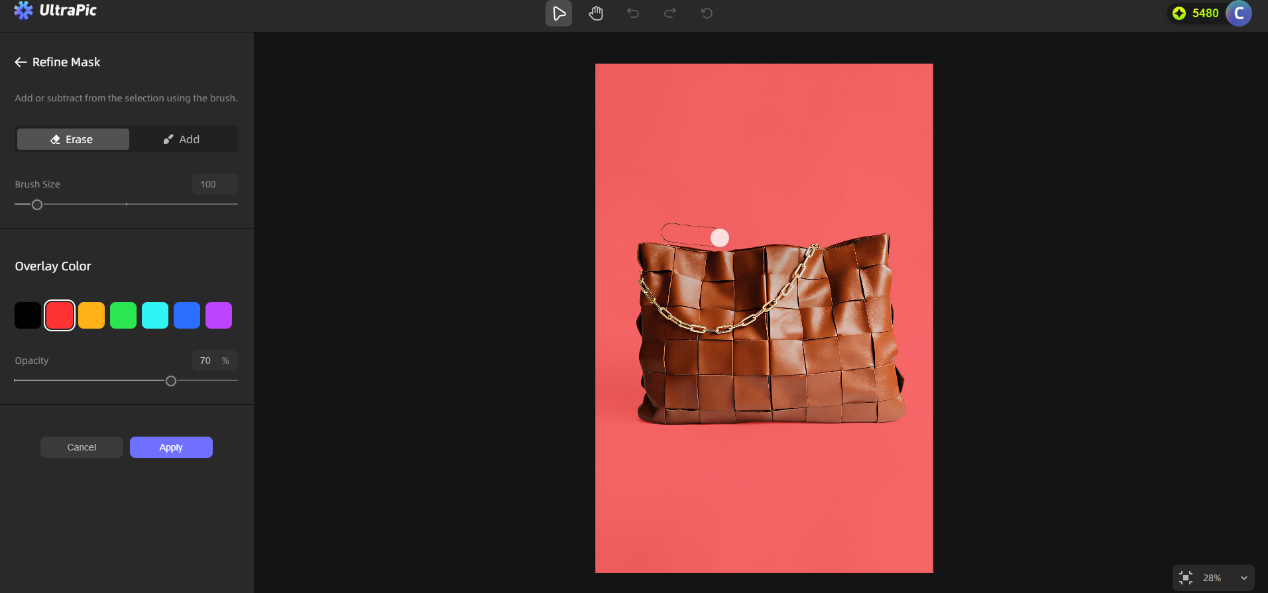

Latest Trends in Nokia Share Price

It was almost right after the news of the Nvidia deal that the Nokia share price went up.

At this moment, Nokia is no longer just a brand of the telecom industry, as the collaboration with AI may lead to a new AI-powered network and data-driven innovation. As a result, analysts of telecom stocks have begun to revise their forecasts of the company’s role in the technology of the upcoming network. Still, some conservatism remains as well. The issuance of new shares to Nvidia has the effect of slightly diluting the current shareholders’ interests. Therefore, while the increase looks wonderful, the real question that awaits is Nokia’s capability to carry out its strategies.

The Big Levers: What Influences Nokia Share Price

Despite all that, Nokia share price is still dependent on several major factors:

- AI infrastructure demand: If AI-driven networks become the norm, the Nvidia partnership may be the reason for a range of new revenue streams.

- 5G and 6G rollout: The success or failure of Nokia in the next generation of connectivity will have a direct bearing on investor confidence.

- Execution and delivery: The act of transforming a strategy into results is what maintains the price at a high level.

- Competition: The presence of strong competitors such as Ericsson and Huawei is what keeps the industry tough.

- Global economy: Exchange rates, inflation, and network spending are among the factors that influence the stock’s move.

Each of these factors is engaged in the daily performance of the Nokia share price.

My Personal Take on Nokia Stock

Last week, I was talking with a friend who has been a long-term shareholder of Nokia.

He chuckled and said, “I knew that they would one day surprise everybody.” Well, he might be right after all.

It has been a very challenging ride for Nokia to come back from its bad days in mobile phones, as evidenced by its share price history, which has been going up and down like a roller coaster. But now with this new AI deal, it looks as if the Finnish company is making a second comeback — only this time, as a serious player in digital infrastructure.

Investing in a company like that, I would pose to myself two questions: Do I have enough patience to wait for the long-term results? And would I be comfortable with the short-term volatility? Because the Nokia storyline is more about tenacity than speed.

The Future of Nokia Share Price Despite The Uncertainties

What happens to the Nokia share price will largely depend on the outcome of the collaboration between the two companies, namely Nokia and Nvidia. There is a possibility of continuous growth if the technology incorporated into network and data-centre products through AI is a success.

On the contrary, if shipping or customer acceptance were to experience some setback, then the hype would probably die down. The market is quite optimistic at the moment, though. The rise indicates that investors are willing to bet on Nokia’s long-term future not only as a provider of telecom services, but also as a major player in the smart connectivity of the future.

Final Thoughts

The Nokia share price today is a testament to the company’s ability to bounce back and reinvent itself.

From being the leader in the era of mobile phones to now collaborating with Nvidia on AI technology, Nokia has indeed traveled a long road.

The very idea behind this recent surge is not only the figures but the transformation. If you are one of those who love stories of comebacks, then this one is worth your close attention. Not only should you track the share price but also the company’s performance, product launches, and strategic moves.

Because sometimes, as Nokia is demonstrating, the most excellent comebacks are the ones that take time — but they are worth the wait.

Also Read:- Qualcomm Share Price: A Friendly Look at What’s Going On?

I am Tech Tobi — the Editor & Admin of Tech Radar Hub, Blogger, and Senior SEO Analyst. My passion is simplifying tech and SEO by giving real, easy-to-understand insights that readers can use to stay ahead. Off the hook of work, I might be found discovering the newest tech updates for you to keep upto date.

Post Comment