Mortgage Rates Today: What Is Happening and How Does It Affect You?

Mortgage rates today : After checking mortgage rates today more times than I opened my Twitter app, I was still not sure what was going on. Rates have been fluctuating wildly and becoming almost indecisive characters. They go down one day, up the other, and then stick around almost as if they are trying to forget what had happened.

However, this doesn’t mean mortgage rates today are irrelevant. They determine if you will be able to buy that house that you always dreamed of, if you can refinance your loan or just get the feeling of being financially stable.

Alright, so we shall dive in to uncover the truth here without the extra complicated language and mixing things up.

Table of Contents

ToggleWhat is mortgage rates today

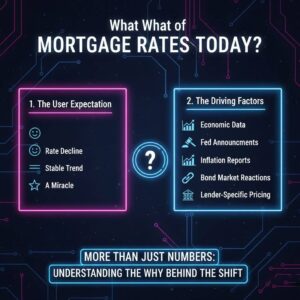

Typically, when folks check mortgage rates today they are are most eager for news that brings a smile to their face. Possibly a rate decline. Perhaps a stable trend. Maybe even a miracle. And in all honesty? There are times when they do.

The current mortgage rates depend on the following factors:

- Economic data

- Fed announcements

- Inflation reports

- Bond market reactions

- Lender-specific pricing

It’s often the case that the rates we are looking at today are already reflecting the worries of the day before as well as the forecasts of tomorrow. This is the reason why they both absorb and exasperate the viewer.

Nonetheless, the essential part is to find out the reason for the change (the movement) rather than just focusing on the figures.

Why It Exists / Why People Search mortgage rates today

Individuals searching for ‘mortgage rates today’ typically are apprehensive in the hopes of being relieved. That relief may come as a drop of the rate, its stabilization, or even as a wonder. Truth be told? News of the sort happens once in a while.

There are a variety of factors that influence mortgage rates today:

- Economic data

- Fed announcements

- Inflation reports

- Bond market reactions

- Lender-specific pricing

In most cases, the rates people are seeing today are a reflection of what the market was afraid of yesterday and what it is predicting for tomorrow. This is why these rates have the power to both attract and irritate people.

Nevertheless, the crucial part is figuring out the reason for the changes (the movements) rather than just focusing on the figures.

Also Read : How to Use 1.5f8-p1uzt: About Its Safely

Why People Search Mortgage Rates Today*

People looking for mortgage rates today are mostly driven by a couple of main reasons:

1. They’re attempting to purchase property

Obligation to pay monthly installments is directly influenced by interest rates.

2. They are willing to get a new loan with a lower rate

Just a minor decrease in the rate can translate into a large amount of money that could be saved.

3. They want to be updated about the economy

Mortgage rates fall when the economy is doing well and vice versa.

4. They’re watching

More than one thousand people in our town treat rate tracking as weather checking.

5. They want to understand

It is so noisy on the internet that people just want to have a simple explanation.

What is more, I find it fascinating how all the sudden there very few people and they are all amateur economists when mortgage rates become volatile.

Breaking Down mortgage rates today: What Really Drives The Numbers

We should not stay at the surface.

1. Inflation Is the Main “Boss” of Them All

Inflation is what controls mortgage rates today the most. When inflation is moderate, rates calm down. But when inflation is high, rates become higher.

One can compare it to a stove that needs to be adjusted.

Lower flame = lower rates.

Higher flame = higher rates.

It’s elementary, but nevertheless quite effective.

2. The Fed’s Words Matter (Even When It Doesn’t Take Actions)

It is the Fed that does not determine mortgage rates.

Nevertheless, mortgage rates act as if the Fed is their very strict parent and they try hard to please it.

Just one clue from the Fed about a future cut or a change in economic direction can immediately bring about a change in rates.

For instance:

- When the Fed is optimistic in its tone → rates usually drop

- When the Fed is concerned about inflation → rates go up

In my opinion, this is the main reason why looking at mortgage rates the day after a Fed meeting always has the feeling of finding out exam results.

3. The Bond Market Reaction

Mortgage rates are very much dependent on the 10-year Treasury yields. When the yields are lowered, mortgage rates are also decreased.

It is as if the two were in a three-legged race: when one moves, the other has to adjust.

4. Lenders Adjust Throughout the Day

This point is much of a surprise for most people.

Mortgage rates today can be changed multiple times within an afternoon. Lenders are constantly informed about market changes and thus, they can change their rates anytime.

Therefore, it is quite possible that getting a quote at 10AM and calling at 2PM will result in you hearing a completely different number.

Real-World Parallel: mortgage rates today Are Like Gas Prices

You know how:

- One station sells petrol for ₹102

- Another for ₹104

- And by evening it’s suddenly ₹106?

The behavior of mortgage rates today is just like that. The same product, different sellers, and there are constant fluctuations.

The difference is that your home loan is for several years. So every tiny change is way more significant.

Why You Should Care About mortgage rates today

Even when not purchasing a house, mortgage rates today have an impact on:

- Real estate prices

- Refinancing opportunities

- Economic growth

- Consumer confidence

- Housing supply and demand

In case you ever get to the point of buying a home, or just want to be sure you are not overpaying, then you should definitely care about that.

From my personal experience, people who closely follow mortgage rates today usually take better financial decisions than those who postpone their decision until “the right time”.

Also Read : Pragatizacao: The Deep Dive You Didn’t Know You Needed

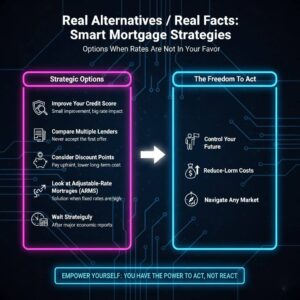

Real Alternatives / Real Facts

Even if mortgage rates today are not favorable, you still have these options:

Improve your credit score

Just a small improvement of 20–30 points can have a significant impact on your rate of interest.

Compare multiple lenders

Always take one quote as a starting point and never as a final decision.

Consider discount points

If you pay upfront, you can lower your long-term costs.

Look at adjustable-rate mortgages (ARMs)

They could be a solution when fixed rates are at their peak.

Wait strategically

It’s sometimes worth waiting a few weeks after a major economic report.

You can use these alternatives to have the freedom to act when rates are not in your favor.

Lessons Behind mortgage rates today

The current trends in mortgage rates tell us these things:

Lesson 1: Rates react to expectations, not just reality

Markets move on anticipation.

Lesson 2: No rate lasts forever

Whether it is good or bad—it will change.

Lesson 3: Timing matters

Whether it is a very small delay, it can either cost you a lot—or save you a big sum of money.

Lesson 4: Economic data rules everything

Reports on jobs, inflation, and growth are the main things.

Lesson 5: Personal finances still matter most

The real offer depends on your credit, income stability, and debt.

Red Flags to Watch For

Watch out for the following when you are checking mortgage rates today:

- Extremely low-rate advertisements that are “too good to be true”.

- Quotes without APR (which hides the fees)

- Rates that need a lot of upfront points

- High lender fees that are disguised as discounts

- Lenders who are operating online and are not verified

If it doesn’t look or feel right, then it probably isn’t.

Conclusion

Today’s mortgage rate’s are a result of various factors such as the rising inflation, the activities of the Fed, the bond market, and the pricing strategies of lenders. Right now, it is really hard to predict what will happen next but getting to understand the forces at play gives you the power — the real power — to make the smartest decisions.

Whether you are a buyer, thinking about refinancing your home, or just wanting to be kept in the loop, knowing the story behind mortgage rate’s today gives you a chance to understand the market and feel secure in your decisions.

And seriously? That’s the biggest leverage you can have.

FAQ About mortgage rates today

1. Why do mortgage rates today change so often?

This is because they are very sensitive to inflation, economic data, and the mood of the market, and they will change immediately in response to any of these.

2. Are mortgage rates today expected to drop?

Maybe, but it is dependent on the reports regarding the inflation and decisions made by the Fed in the future.

3. How can I get a lower rate today?

Keepr your credit score good, lenders should be comparing and do not take on debt unless necessary.

4. Why are different lenders offering different rates today?

Different lenders have different pricing structures, risk evaluation methods, and approaches to the market.

5. Should I lock my rate today?

It could be a wise decision to lock if the interest rate is acceptable to you and the market appears unstable.

I am Tech Tobi — the Editor & Admin of Tech Radar Hub, Blogger, and Senior SEO Analyst. My passion is simplifying tech and SEO by giving real, easy-to-understand insights that readers can use to stay ahead. Off the hook of work, I might be found discovering the newest tech updates for you to keep upto date.

Post Comment