Bajaj Finance Share Hit Hard — Should Investors Worry?

Table of Contents

ToggleIntroduction

The market this week has been a roller coaster ride of emotions. Especially a drop in the bajaj finance share caught my eye and by the way, it was my friend who during the evening tea break I was talking with, and the drop honestly surprised both of us. The bajaj finance share is a power stock that doesn’t usually show weakness, so the sudden fall pushed me to find out the reasons behind it.

Understanding the Recent Slide in the Bajaj Finance Share

What we know about the bajaj finance share would imply that a sharp dip like that should have caught your eye. It surely wasn’t a mere correction. It was a strong indication of a very loud market reaction to the new developments. The company’s figures, as a whole, are still looking good, however, the mood around the bajaj finance share has turned pessimistic.

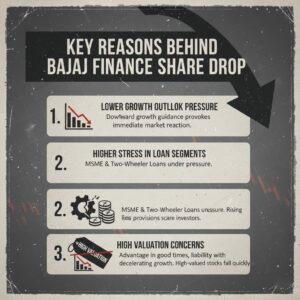

Key Reasons Behind the Drop

1. Lower Growth Outlook Pressure

The downward direction of the growth guidance is one of the main factors that contributed to the fall of the bajaj finance share. Lower growth forecast, even by a little, is enough to provoke an immediate reaction from markets. I can give an example from my own experience where I had another stock and such an occasion happened. Simply put, the moment guidance is lowered, the stock tends to go down, just like what happened to the share this week.

2. Higher Stress in Loan Segments

Micro, small, and medium enterprise (MSME) loans and two-wheeler loans are areas where the pressure has been mounting. The investors in the bajaj finance share have been scared by the raising of provisions and the onset of stress in these sectors. Loan books getting stressed is not a situation in which markets can remain calm.

3. High Valuation Concerns

It has been a tradition that the bajaj finance share stock was priced high. This is an advantage when the times are good but becomes a liability when the growth decelerates. The high-valued stocks are the ones that fall quickly. I have been in situations like this before, therefore, after seeing the details, I was not surprised and reacted sharply.

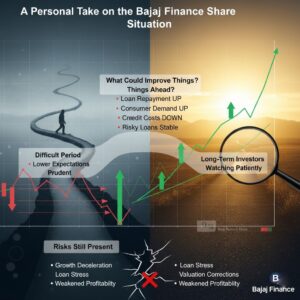

A Personal Take on the Bajaj Finance Share Situation

The case with the bajaj finance share is similar to a friend whom you talk about when he is going through a difficult period. The basics are still there. The thing is that the expectations got lower. I didn’t find anything scary when I looked at the numbers. Rather, the feeling was that the company was just being prudent.

For long-term investors, the bajaj share is still a stock to keep an eye on. Not investing right away but watching patiently.

What Could Improve Things Ahead?

Good times could come for the bajaj finance share if only a few positive factors become a reality:

- Trend of loan repayment getting better

- Lending demand from consumers picking up

- Next quarter bringing much stronger guidance

- Credit costs coming down

- Risky loan segments stabilizing

Risks Still Present

As I hold a positive view, the bajaj share is not without dangers:

- Growth might decelerate even more

- Loan stress could spread to other categories

- More corrections could be seen in high valuations

- Profitability may be weakened by provisions

Due to these factors, the bajaj finance share may continue to be unpredictable for a certain period.

Final Thoughts

After all, I think that the reaction of the bajaj finance share is the market revising its expectations towards the company rather than the market punishing the company. It’s more of a repositioning. The fundamentals of the bajaj share are still strong, but the pressure in the near term is there.

It’s a good idea to be careful with your money and think one step ahead. Perhaps you might want to keep an eye on the bajaj finance share in the upcoming quarter.

Also Read:- New Tesco Purchase Quantity Limits: What You Must Know Before Your Next Shop

I am Tech Tobi — the Editor & Admin of Tech Radar Hub, Blogger, and Senior SEO Analyst. My passion is simplifying tech and SEO by giving real, easy-to-understand insights that readers can use to stay ahead. Off the hook of work, I might be found discovering the newest tech updates for you to keep upto date.

Post Comment