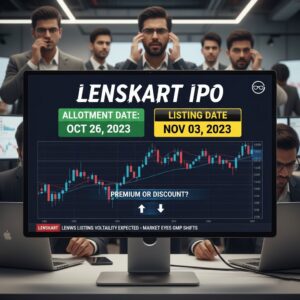

Lenskart IPO Allotment: Latest Updates, GMP Trend, Listing Date & What Investors Should Know

If you were watching the markets recently, you would have probably heard the loudest talk about the lenskart ipo allotment and the steep drop of its GMP. Even my circle of investors is talking about it non-stop. Some of my friends got their ipo allotment status checked the very moment it was available, and their emotions were quite different—some were ecstatic, while others kept refreshing the page, as if it was a cricket score!

This piece brings to you the freshest update, user-type real insight, and a friendly explanation of the situation. So, get your coffee and let’s talk investing.

Table of Contents

ToggleUnderstanding the Lenskart IPO Allotment

Among the most significant events that attracted attention was that of the lenskart ipo allotment. Immediately after the subscription window closing, the next big question was quite obvious—“Have I been allotted or not?”

It is very simple to check your lenskart allotment status on NSE or BSE, but what is fascinating is how the digits are forming the expectations of the markets. Despite the fact that the issue was highly demanded, the GMP IPO is indicating a reluctant approach.

Lenskart Allotment Date & Listing Date

We all want to know when the big event will take place. The Lenskart allotment date was definitely on time, the investors were giving a rush of adrenaline as they checked their allotment.

It is now the lenskart listing date that draws up the most attention, and the traders are of the opinion that it is going to be a turning point. Everyone is eager to find out whether the listing will be at a premium or go lower than what was expected, particularly after the GMP changes.

The talk that has been going on the market has been updated to the effect that the lenskart ipo listing date might not be as smooth as usual and instead, there might be quite a lot of fluctuations.

Why Did Lenskart IPO GMP Fall Sharply?

This is the most important question. Many investors noticed that the ipo gmp today went down significantly a week before the listing.

Some of them were even preparing for a strong premium. Nonetheless, the abrupt plunge mirrors:

- Depressed global stone

- Overvaluation worries

- Grey market buyers being cautious

- Early bidders taking profits

I met with two of my friends who are into daily gmp ipo value tracking (yeah, full obsession mode!), and they are of the opinion that the fall doesn’t always mean a weak listing—though, it certainly is a warning sign.

Lenskart Share Price Expectations

The great question around lenskart is what the share price would be on the day of listing. Analysts are not unanimous. Some of them argue that due to the brand being highly visible, it can result in good listing gains. On the other hand, some point out that the sentiment is unstable and that the GMP drop is evidence of that.

If you are following the bse share price or nse trends of the companies going public, you may already be able to tell that the day of listing is a volatile one.

Comparing With MUFG IPO Allotment

Lots of people have compared the MUFG IPO and Lenskart in terms of hype. Quite interestingly, when the mufg ipo allotment status was released earlier this year, the overall mood was more calm and steady. The mufg ipo allotment did not experience such a considerable negative GMP drift.

That’s the reason why investors are considering MUFG as a yardstick while examining the Lenskart debut.

IPO Allotment Trends & What Investors Are Thinking

Yearly, the landscape of the broad ipo allotment shows a pattern that tempted ones initially and then suddenly the GMP drops followed. Lenskart is not the only one that has this pattern.

However, here is the retail investor’s opinion majority (including me):

- The IPO market still has its charms

- Strong brands are a safer choice

- The GMP can be a great tool, but it is not a certainty

- Thinking long-term is better than panic selling

Talking to investor friends, we can never stop laughing at how everyone forgets the IPO after listing—until the next big issue hits the market!

Should You Invest or Wait? (Friendly Advice)

In case you have not been given an allotment of the Lenskart IPO, do not put yourself under pressure. A scenario could be that by missing the allotment, you are spared from a risky listing. At other times, you are deprived of the chance to make a good profit—such is the IPO game.

Prior to your market entry on listing day:

- Keep an eye on the latest GMP

- Check out the early trades on BSE & NSE

- Read up on listing-day reports

- Don’t fall victim to emotional buying

Investing is a thrill, but the winning moves are always the thoughtful ones.

Final Thoughts

It’s fair to say that Lenskart’s IPO allotment has been the talk of the town not only for the drop in GMP but also for the confusion and mixed expectations of the listing. Therefore, it is crucial for investors to remain vigilant.

Nevertheless, Lenskart’s established brand coupled with the company’s long-term strategy is a strong bet for stability beyond the commotion of the listing.

Also Read:- tesco purchase quantity limits

I am Tech Tobi — the Editor & Admin of Tech Radar Hub, Blogger, and Senior SEO Analyst. My passion is simplifying tech and SEO by giving real, easy-to-understand insights that readers can use to stay ahead. Off the hook of work, I might be found discovering the newest tech updates for you to keep upto date.

Post Comment